41 irs mileage rate 2022

Standard IRS Mileage Rates: 2022 Guide for the Self-Employed What Are the IRS Standard Mileage Rates for 2022. Choosing a Deduction Method. Track Miles on the Go. More Resources on Small Business Accounting. What Are the IRS Standard Mileage Rates for 2022. The IRS allows you to deduct a standard mileage rate from your earnings to lower your taxable... IRS Announces 2022 Mileage Reimbursement Rate - Small Business... The IRS just released the 2022 standard mileage rate, and it comes with some increases. The rate goes up for business use and medical or moving purposes for qualified active-duty members of the Armed Forces. But it stays the same for charitable organizations.

IRS Raises Standard Mileage Rates for 2022 | - CBIA 1, 2022, the standard mileage rates for using a car, van, pickup, or panel truck will be 58.5 cents per mile for work use. The IRS said the rate for driving in service of charitable organizations is unchanged for 2022 at 14 cents per mile driven. The rate was set by statute.

Irs mileage rate 2022

2022 IRS Mileage Rate: What Businesses Need to Know What factors will determine the 2022 IRS mileage rate? The IRS monitors trends in business driving based on analysis from the world's largest retained pool of drivers to calculate this rate, which is then used to determine taxation. If a company provides a reimbursement higher than the IRS standard... 1 thought on "IRS Standard Mileage Rate 2021 and 2022" The IRS standard mileage rate for medical purposes, or for miles driven while moving is 16 cents per mile, which is also down 1 cent per mile from the 2020 Beginning with miles driven on January 1, 2022 and through December 31, 2022, taxpayers must use the 2022 standard mileage rates. IRS Standard Mileage Rates for 2021-2022 - NerdWallet In 2022, the mileage rates increase for business and medical or moving miles (58.5 cents and 18 cents, respectively), while the charity mile rate remains the same (14 cents). You must meet certain requirements and itemize your taxes to deduct mileage. If you qualify to deduct mileage, the IRS...

Irs mileage rate 2022. IRS Mileage Rates for 2022: What Can Businesses Expect For The... How Will 2022 IRS Mileage Rate Impact Your Business? Even before the IRS mileage rate for 2022 was officially announced, based on high gas prices, increasing maintenance costs, and insurance rates, it was expected that it would go up to reflect the rise in costs of operating a vehicle. Now that the IRS... IRS issues standard mileage rates for 2022 | Internal Revenue Service WASHINGTON — The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. 2022 IRS Mileage Reimbursement Rates The 2022 federal mileage reimbursement rates have arrived. These are issued by the Internal Revenue Service (IRS) to calculate costs for operating vehicles for business, charitable, medical or moving purposes. In summary, the business mileage rate increased two and a half cents for business... Free Mileage Reimbursement Form | 2022 IRS Rates... | PDF - eForms Current (2022) IRS Mileage Rate (Source). Business: $0.585 (58.5 cents). Medical or Moving: $0.18. Charitable Organization: $0.14. This is a flat rate that is the same for all vehicles. No matter if it's an electric vehicle or pickup truck. Mileage Rates By Year.

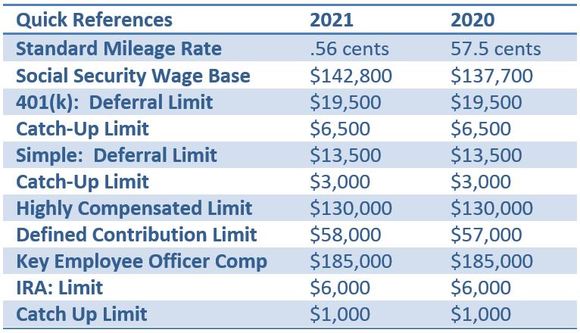

2021 Standard IRS Mileage Rates for Automobile Operation Standard Mileage Rates 2021, 2022. Don't like reading Tax Mumbo Jumbo? We hear you! It can be complicated to keep up with the latest tax deductions Below are the optional standard tax deductible IRS mileage rates for the use of your car, van, pickup truck, or panel truck for Tax Years 2007-2022. IRS Mileage Rate 2022 - IRS - TaxUni The Internal Revenue Service sets the standard mileage rates for business and medical/moving. The rates are subject to a change every year with the As soon as the IRS updates the rates for the 2022 tax year, we'll keep you updated. The IRS generally releases the inflation adjustments towards the... IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover... The Internal Revenue Service announced standard mileage rates for 2022 today for taxpayers to use in calculating the deductible costs of using a car for... Standard IRS Mileage Rates Increase In 2022 | TripLog The IRS has finally announced the standard business mileage rate for 2022. As we predicted previously, the rate has gone up from 56 cents to The rate for miles driven in service of charitable organizations remains unchanged from last year. How the IRS Determines the Standard Mileage...

What is the IRS Mileage Rate for 2021, 2022? Current Mileage... For anyone expecting to claim mileage on their taxes in 2022, it's an exciting time. The IRS has released the new mileage rate. Let's discuss what you need to know about the IRS mileage rate and what you can expect from the IRS this year. Table of Contents. 1 What is the Mileage Rate? What Are The IRS Mileage Rates? (Updated 2022) | Bench Accounting The IRS mileage rate determines how much money you can write off when you use your vehicle for business. For many businesses, mileage is the The IRS increases the standard mileage rate (or mileage reimbursement rate) each year to keep pace with inflation. The mileage rate for the 2022 tax... What is the Current IRS Mileage Rate Tax Deduction 2021, 2022? Under current IRS rules, you can deduct a certain amount in mileage rates if you happen to be using your vehicle for business reasons. Every year, the IRS publishes a list of the current standard mileage rates, and the amount you can deduct on your taxes. IRS mileage rate 2022 - what is the mileage rate for 2022? Find the IRS mileage rate 2022 and what you should expect for your reimbursement in this year. The new standard mileage rate for 2022 will be the one you need to use for calculating your reimbursement from January 2022 and forward until the end of the 2022 year.

IRS Raises Standard Mileage Rate for 2022 The standard mileage rate that businesses use to pay tax-free reimbursements to employees who drive their own cars for business will be 58.5 cents per mile in 2022, up 2.5 cents from 2021, the IRS announced.

2022 IRS Federal Mileage Deduction Rates | Hurdlr Use this as a guide to 2022 IRS standard mileage deduction rates. As of January 1, 2022, you will be able to deduct 58.5 cents per mile on your taxes for your business mileage. This is something to take into consideration while you track your expenses throughout 2022.

IRS ISSUES 2022 MILEAGE RATES - Fox, O'Neill & Shannon, S.C. The Internal Revenue Service has issued its 2022 standard mileage rates which taxpayers can use to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. The 2022 standard mileage rates are

New 2022 IRS Standard Mileage Rates IRS standard mileage rates will increase to 58.5 cents per mile in 2022, up from 56 cents per mile in 2021.

What is the IRS Mileage Rate for 2022? | File My Taxes Online The IRS mileage rate is typically updated each year, and the new rate for 2022 has just been announced. The IRS has released the 2022 optional standard mileage rates, which are used to determine the deductible expenses of driving a car for business, charity, medical, or relocating reasons.

IRS Standard Mileage Rates 2022 - IRS - Zrivo The Internal Revenue Service updates the mileage rates against inflation and changes to the cost of living. Due to the high inflation throughout 2021, we. 2 Business mileage rate 2022. 3 Medical and moving. 4 Charity. 5 Claiming a deduction for vehicle expenses. The Internal Revenue Service...

2022 Mileage Rates: What Employers Need to Consider Understanding these rates and the Internal Revenue Service's (IRS) mileage rate, in particular, ensures that your business is compliant with the law. Learn more about the IRS mileage rate in 2022 and mileage reimbursements and use the provided tips to help you reimburse your employees...

Current and Historical IRS Mileage Rates for Years 2000-2022 Click to view current & historical IRS Mileage Reimbursement Rates for the years 2000 thru 2019. Be careful: Google often displays outdated/inaccurate info! 2021 Federal IRS Mileage Rates: Business: 56 cents; Medical or Moving: 16 cents; Charitable: 14 cents.

IRS Announces Standard Mileage Rates for 2022 The Internal Revenue Service (IRS) just released standard mileage rates that taxpayers must use when filing 2022 income taxes in 2023 if they are claiming a mileage deduction for a vehicle they own or lease. These rates set IRS allowances for the deductible part of the cost of driving for business and...

About Us | IRS Mileage Rate 2022 Mileage Rate For 2022 Medical Travel. 2021 Irs Mileage. 2022 Mileage Reimbursement Rate. Milage Rate 2021.

GSA Per Diem Rates 2022 & GSA Mileage Rate 2022 - Government... The current government mileage rate 2021 from the GSA is 56 cents per mile, down from 57.5 cents per mile in 2020. Stay tuned for the newest 2021 The rate for medical and moving purposes is based on the variable costs: IRS Mileage Rates 2022. To facilitate mileage updates in DATABASICS, click...

New IRS Standard Mileage Rates in 2022 - MileageWise The Internal Revenue Service (IRS) has issued a new standard mileage rate for driving a car for business, charity, medical, and moving purposes. The new IRS Standard Mileage Rate is in effect from January 1, 2022.

IRS Standard Mileage Rates for 2021-2022 - NerdWallet In 2022, the mileage rates increase for business and medical or moving miles (58.5 cents and 18 cents, respectively), while the charity mile rate remains the same (14 cents). You must meet certain requirements and itemize your taxes to deduct mileage. If you qualify to deduct mileage, the IRS...

1 thought on "IRS Standard Mileage Rate 2021 and 2022" The IRS standard mileage rate for medical purposes, or for miles driven while moving is 16 cents per mile, which is also down 1 cent per mile from the 2020 Beginning with miles driven on January 1, 2022 and through December 31, 2022, taxpayers must use the 2022 standard mileage rates.

2022 IRS Mileage Rate: What Businesses Need to Know What factors will determine the 2022 IRS mileage rate? The IRS monitors trends in business driving based on analysis from the world's largest retained pool of drivers to calculate this rate, which is then used to determine taxation. If a company provides a reimbursement higher than the IRS standard...

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

0 Response to "41 irs mileage rate 2022"

Post a Comment